AK GEN 156 2010-2024 free printable template

Show details

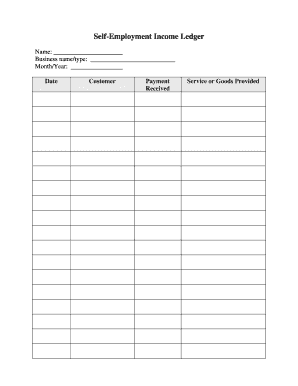

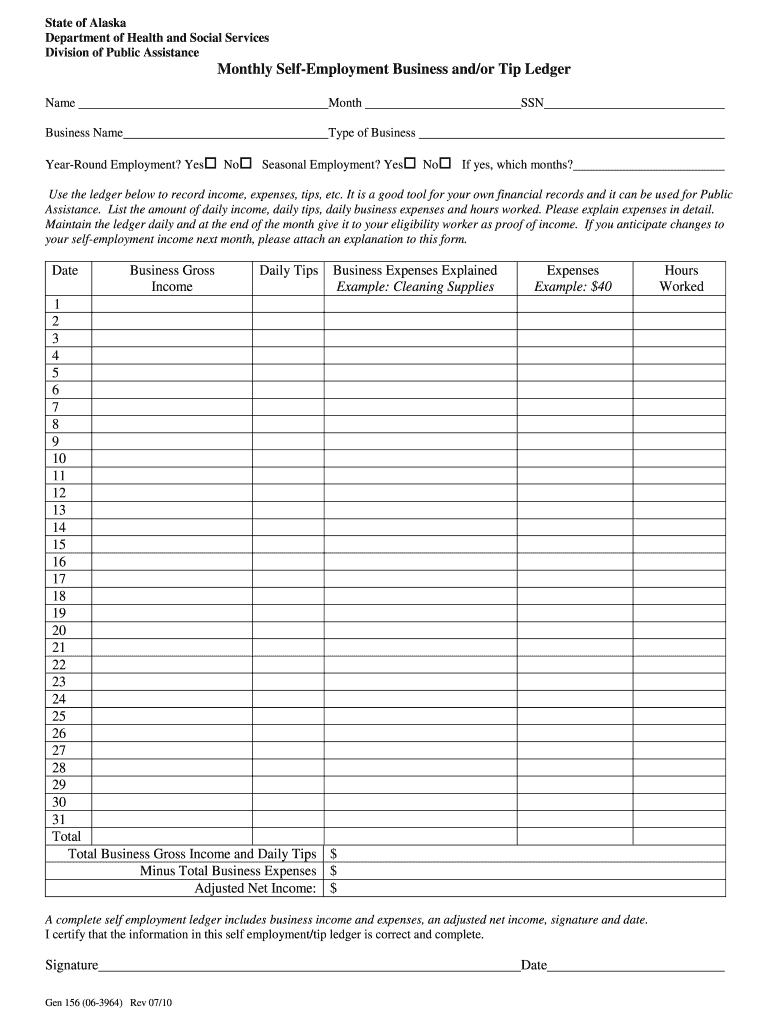

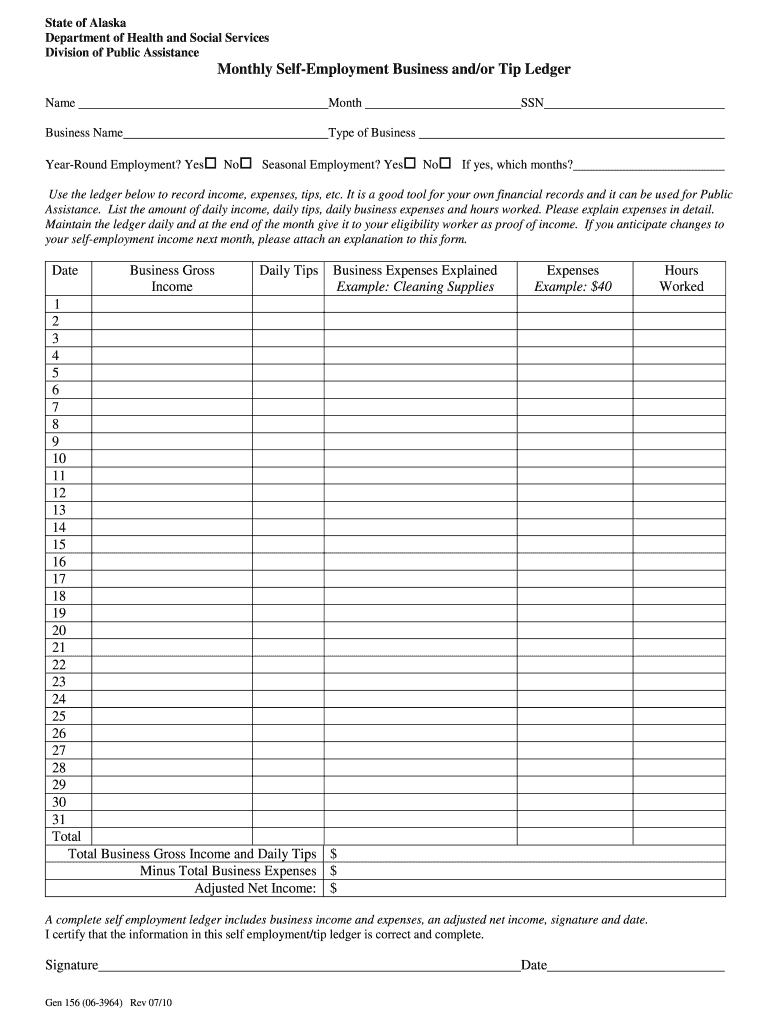

State of Alaska Department of Health and Social Services Division of Public Assistance Monthly Self-Employment Business and/or Tip Ledger Name Month Business Name SSN Type of Business Year-Round Employment?

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your self employment ledger template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employment ledger template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self employment ledger template online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit self employment ledger form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

How to fill out self employment ledger template

How to fill out self employment ledger:

01

Gather all necessary documents such as income statements, receipts, and invoices related to your self-employment activities.

02

Start by entering your personal information at the top of the ledger, including your name, contact details, and social security number.

03

Create a section for each month or time period you are documenting. Label each section with the appropriate month or time frame.

04

In each section, record your income for that specific period. This can include money received from clients, sales, or any other sources related to your self-employment.

05

Deduct any allowable business expenses from your income. This may include supplies, equipment, advertising, and travel expenses. Make sure to keep detailed records of these expenses for tax purposes.

06

Calculate your net self-employment income by subtracting your business expenses from your total income for each month or time period.

07

Total up your net self-employment income for the entire year and enter it in the designated space on the ledger.

08

Review your entries for accuracy and completeness. Make any necessary adjustments or corrections.

09

Keep a copy of the completed self-employment ledger for your records and submit it as required by any relevant entities, such as tax authorities or lenders.

Who needs self employment ledger:

01

Self-employed individuals who earn income from their own business or freelance work.

02

Contractors or gig workers who provide services to multiple clients.

03

Individuals seeking financial assistance or loans that require documentation of their self-employment income.

04

Freelancers or independent contractors who need to report their income and expenses for tax purposes.

05

Those who are applying for housing or rental applications and need to substantiate their income from self-employment.

Fill self employment ledger example : Try Risk Free

People Also Ask about self employment ledger template

How do I record self-employment income?

What document proves self-employment?

How do I document self-employment income?

How do you write a self-employment ledger?

How do I report self-employment income without a 1099?

What is a ledger for proof of income?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of self employment ledger?

A self-employment ledger is a tool used by independent contractors and freelancers to keep track of their income and expenses for tax purposes. It is a detailed record of all the transactions related to a business’s operations, including income, expenses, and other financial information. A self-employment ledger can help freelancers and independent contractors keep track of their financial information, allowing them to accurately report their taxes and plan for their financial future.

What is the penalty for the late filing of self employment ledger?

The penalty for late filing of a self-employment ledger depends on the country or region in which the individual is operating. Generally, self-employed individuals are subject to fines or other penalties imposed by the relevant tax authority if they fail to file a self-employment ledger on time.

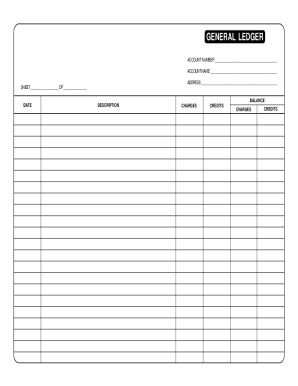

What is self employment ledger?

A self-employment ledger is a document that contains a record of all the self-employment income and expenses of an individual. It is typically used by self-employed individuals to track their business finances and to calculate their net profit for tax purposes.

The ledger typically includes information such as the date of each transaction, the nature of the income or expense, the amount, and any relevant notes or descriptions. It provides a detailed overview of the financial activities of the self-employed individual, helping them to manage their business finances effectively and accurately report their income and expenses to the tax authorities.

The self-employment ledger is an important tool for self-employed individuals to keep track of their business income and expenses, maintain financial records, and fulfill their tax obligations.

Who is required to file self employment ledger?

Individuals who are self-employed or operate their own business are required to file a self-employment ledger. This includes freelancers, independent contractors, sole proprietors, and individuals who receive income from other self-employment activities. It is important to maintain and report accurate records of income and expenses when filing taxes as a self-employed individual.

How to fill out self employment ledger?

To fill out a self-employment ledger, follow these steps:

1. Gather your records: Collect all relevant financial documents, including income and expense receipts, invoices, and bank statements that relate to your self-employment activities.

2. Create a ledger template: Use a spreadsheet software like Microsoft Excel or Google Sheets to create a ledger template. Create columns for date, income, expenses, description, and total.

3. Record income: Start by recording all the income you have earned from your self-employment activities. List the date of each transaction, the source of the income, and the amount received. Be sure to include any cash or check payments received from clients or customers.

4. Track expenses: Next, list all your self-employment expenses. Include all expenses incurred for your business, such as supplies, equipment, advertising costs, insurance premiums, and any other relevant costs. Be detailed in your descriptions and also record the date and amount spent for each expense.

5. Calculate totals: At the end of each column (income and expenses), calculate the total. This will give you an overview of your total income and expenses for the specified period.

6. Monitor profit or loss: Subtract your total expenses from your total income to determine whether you made a profit or experienced a loss during the specified period. Record this figure in a separate column.

7. Keep records organized: Maintain organized physical and digital copies of all the documents you used to fill out the ledger, as they may be required for tax purposes or if you are ever audited.

It is recommended to consult with a tax professional to ensure accurate completion of your self-employment ledger, as different jurisdictions may have specific requirements.

What information must be reported on self employment ledger?

The specific information that must be reported on a self-employment ledger may vary depending on the jurisdiction and the purpose of the ledger. However, generally, the following information is typically included:

1. Business information: The name, address, and contact details of the self-employed individual or the business entity.

2. Income details: The amount of income earned from self-employment during a specific period. This may include income from sales, services, or any other sources related to the self-employment.

3. Expense details: The expenses incurred in running the self-employment business. This may include costs such as rent, utilities, supplies, equipment, advertising, business insurance, and any other deductible expenses.

4. Profit or Loss: The calculation of profit or loss for the specific period. This is typically calculated by subtracting the total expenses from the total income.

5. Total receipts: A record of all income received, including sales receipts, invoices, or any other relevant documentation.

6. Business-related assets: Information about any assets used for the self-employment business, such as equipment, vehicles, or property.

7. Business liabilities or debts: Details of any outstanding debts or liabilities related to the self-employment business, such as loans or credit card balances.

8. Taxes and deductions: Information related to taxes paid, including self-employment taxes, and any deductions or credits claimed.

9. Supporting documentation: Copies of invoices, receipts, bank statements, and any other relevant documentation that supports the income and expenses reported in the ledger.

It is essential to consult the specific requirements of your jurisdiction or the institution requesting the self-employment ledger for accurate and complete reporting.

How can I edit self employment ledger template from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including self employment ledger form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit self employment ledger pdf straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing income ledger template right away.

Can I edit printable blank self employment ledger sheets on an iOS device?

You certainly can. You can quickly edit, distribute, and sign self employment ledger for food stamps form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your self employment ledger template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Employment Ledger Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to self employment income ledger template form

Related to ledger documentation

If you believe that this page should be taken down, please follow our DMCA take down process

here

.